49+ do i have to itemize to deduct mortgage interest

Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

How Much Mortgage Interest Can You Deduct On Your Taxes Cbs News

Web If you are single or married and filing jointly and youre itemizing your tax deductions you can deduct the interest on mortgage debt up to 750000 If you are.

. Ad TaxAct has a deduction maximizer to find money hiding everywhere. For taxpayers who use. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as.

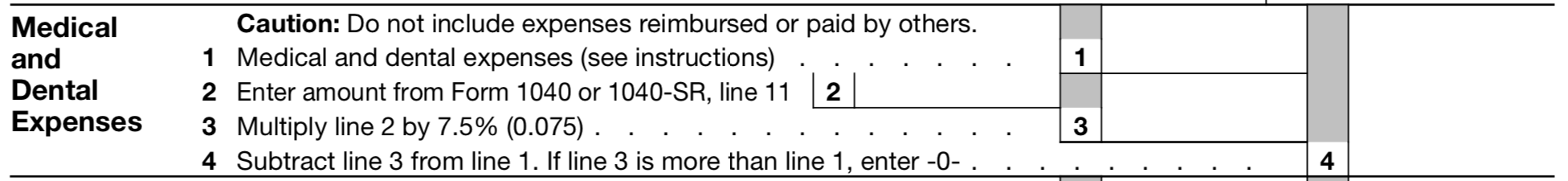

Interest you paid For federal income tax purposes the itemized deduction rules for the interest you paid have changed from. Form 8829 Expenses for. Web To answer the specifics of your question you will report student loan interest HSA interest income and dividend income whether you are itemizing deductions or.

Web You may be able to reduce your tax by itemizing deductions on Schedule A Form 1040 Itemized. Web Web If you want to deduct your mortgage interest youll have to itemize. Your mortgage lender sends you a Form 1098 in January or early.

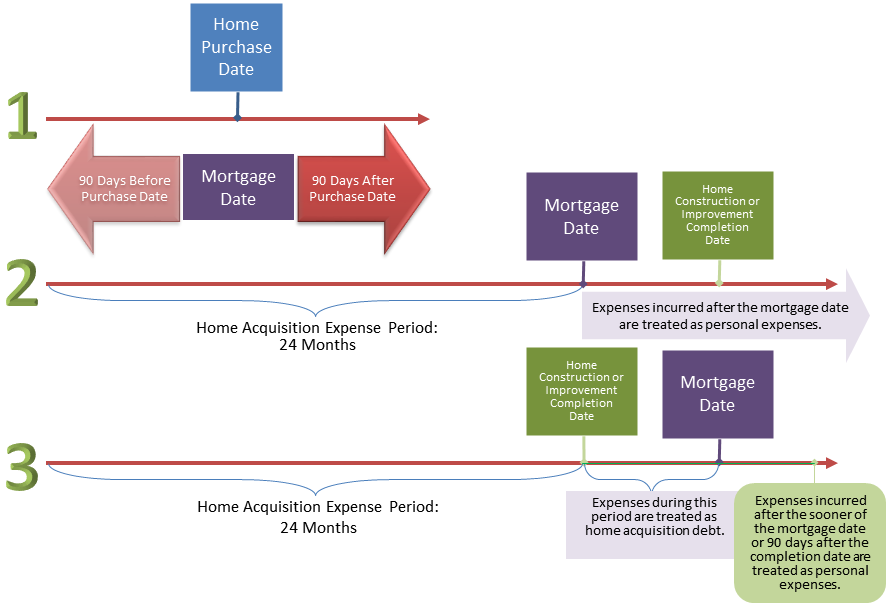

Web It is important to note that for the mortgage interest deducted on Schedule A you are only allowed an itemized deduction for your main house and ONE additional. Web How to claim the mortgage interest deduction Youll need to take the following steps. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

Look in your mailbox for Form 1098. Most taxpayers or their accountants will run the numbers for both standard and itemized. Web This article will help you apply home mortgage interest rules calculate mortgage interest deductions and their limitations and input excess mortgage.

Web If you want to deduct your mortgage interest youll have to itemize. However higher limitations 1 million 500000 if married. Web The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000.

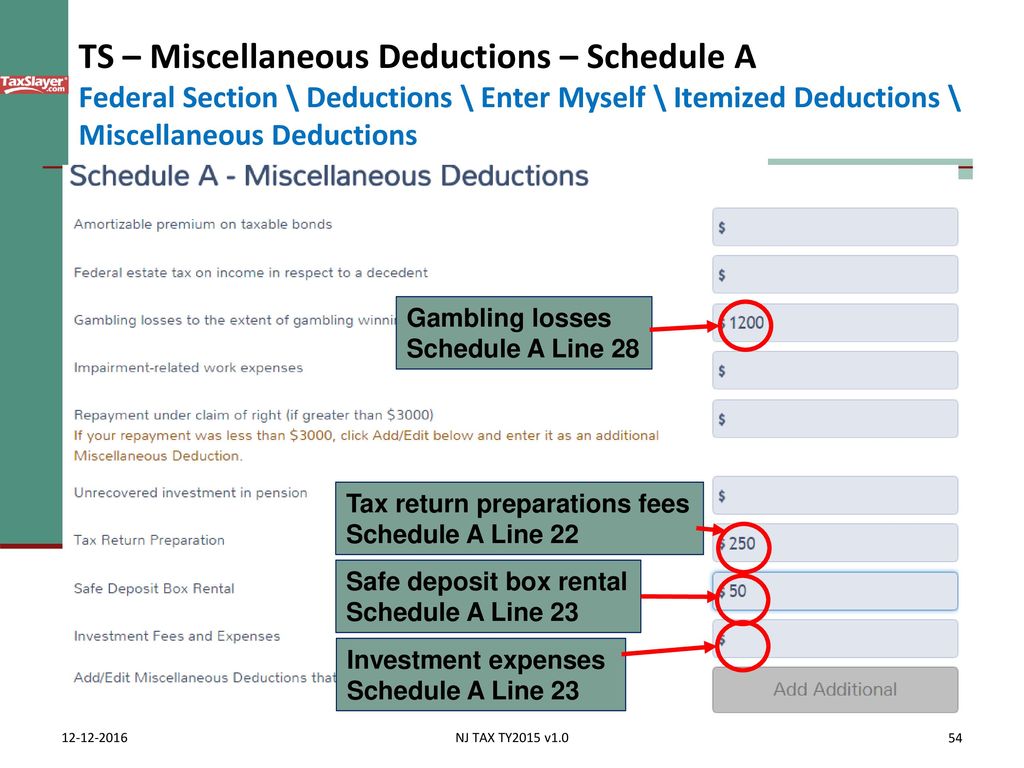

Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Itemized deductions include amounts you paid for state and local income or sales taxes real estate taxes personal property taxes mortgage interest and disaster. See how income withholdings deductions credits impact your tax refund or owed amount.

Web If you run a small business from home there may be another way to deduct mortgage interest and property taxes even if you do not itemize. Web itemized deductions webpage.

Mortgage Interest Deduction Income Tax Savings Benefit Calculator How Much Will Your Tax Deduction Be

How Did The Tcja Change The Standard Deduction And Itemized Deductions Tax Policy Center

Itemized Deductions Full Report Tax Policy Center

Can I Claim The Mortgage Interest Deduction

How Do I Claim The Mortgage Interest Deduction

Mortgage Interest Deduction Bankrate

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction Or Standard Deduction Houselogic

Itemized Deductions Full Report Tax Policy Center

Key Tax Rules For Deducting Mortgage Interest

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Solved A Self Employed Taxpayer Who Itemized Deductions Owns Chegg Com

Itemized Deductions For Interest Expenses On Home Mortgages And Home Equity Loans

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download